The smart Trick of chapter 7 bankruptcy That No One is Discussing

You may check with the bankruptcy courtroom to justification your accountability by filing a Chapter 13 prepare modification for anyone who is needed to pay your tax return. You need to file a individual strategy modification annually that features:

If You can't exempt your refund, whatsoever will not be protected needs to be handed about on the bankruptcy trustee. If you do not do this, your bankruptcy discharge will be revoked, so you will go on to owe your debts.

Most ideas spend a small share towards unsecured personal debt—It can be considered one of the key benefits of Chapter 13. However, for anyone who is in a single of these two teams, you very likely spend a A lot bigger percentage:

Chapter 13 bankruptcy is most effective suited for individuals who definitely have a gradual profits and assets that they will want to cling on to. An experienced Fredericksburg Chapter thirteen bankruptcy attorney

The tax preparing assistant will validate The client’s tax circumstance in the welcome call and assessment uploaded files to assess readiness. All tax types and files have to be Prepared and uploaded by The shopper for that tax preparing assistant to refer the customer to an obtainable pro for Stay tax preparation.

The impression of bankruptcy in your tax return could vary greatly determined by the sort of bankruptcy filed and the nature within your tax debts. It may likely bring on the discharge of certain tax debts, adjustments in tax deductions, plus the creation of a independent taxable entity generally known as a bankruptcy estate.

“New personal debt that someone acquires while previously inside a bankruptcy will not be protected from collection because of the bankruptcy court, mainly because it wasn't disclosed from the Original filing,” Barger look here stated.

Some states also have a wildcard exemption. In the event the wildcard exemption isn’t ample to safeguard all of your residence and also your tax refund, you might want to utilize the exemption towards your tax refund first. The trustee is more likely to have a liquid (hard cash) asset similar to a tax refund than other forms of residence that choose time and expense to transform to dollars.

Woodbridge, VA Private Harm Regulation: The private harm cases our attorneys commonly take on involve Virginia auto accident litigation, premises legal responsibility, item liability, wrongful Loss of life, or another individual harm or fatality seasoned due Get More Information to the negligent actions of One more unique.

You’ll consider house more money from Every paycheck and likely won’t get a tax refund the subsequent 12 months. When you go this route, while, you might turn their explanation out owing taxes when you file your return.

Document expenditures by retaining receipts if you receive court authorization to keep the refund. Find out Full Article about selections If you cannot make your Chapter thirteen plan payments.

With a Chapter 7 bankruptcy, the bankruptcy trustee liquidates all your non-exempt belongings you could check here and takes advantage of the proceeds to pay for your creditors. Any qualified debts that continue to be are discharged, that means you would not have to pay for them.

C., in Hamilton, New Jersey. “Your affairs come to be A part of an ‘estate,’ the exact same way they would be should you ended up incapacitated or if you experienced died. The trustee's sole obligation is to pay creditors with any assets that aren't exempt underneath federal or point out law, whichever is applicable.”

Extremely inexpensive in comparison with paying out A large number of bucks on an attorney, Luckily it had been alternatively easy and swift to file all the things given that I haven't got A great deal that needed to be filed. All round, wonderful option for individuals who are minimal on funding and want to file for bankruptcy.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Robbie Rist Then & Now!

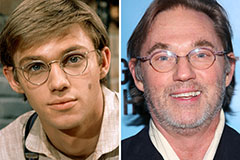

Robbie Rist Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!